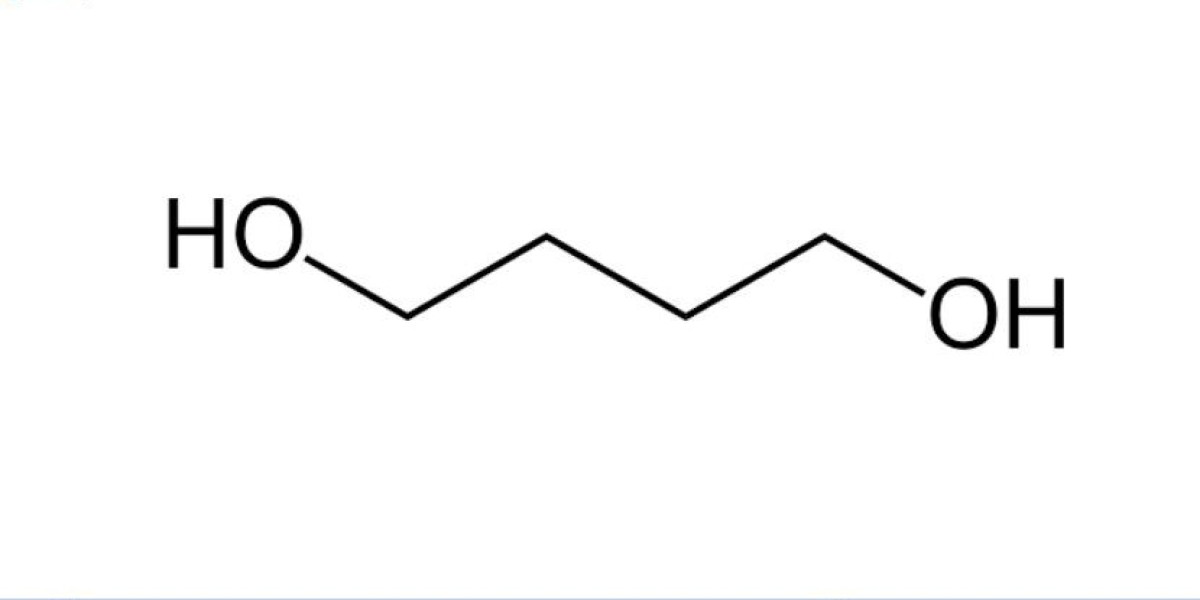

The 1,4-Butanediol (BDO) Market Outlook is critical for understanding the dynamics of a vital chemical compound used across a wide range of industries. From the production of plastics, fibers, and solvents to the creation of important polymers and specialty chemicals, BDO serves as a key building block in numerous applications. With increasing demand in automotive, electronics, pharmaceuticals, and textiles, the global BDO market is experiencing significant growth.

In 2023, the global capacity of 1,4-butanediol was around 4,000 Kilo Tons (KT), and it is projected to reach 5,300 KT by 2032, with a compound annual growth rate (CAGR) driven by industry advancements and demand. The Asia Pacific region continues to dominate global production, with China leading the charge and holding an estimated 62% of the market capacity in the region. Nearly 90% of China's capacity is based on the acetylene-based Reppe route, a historical manufacturing process that remains prevalent due to its cost-effectiveness. Despite the strong supply base in Asia, the global plant capacity utilization for BDO stood at 73% in 2023, suggesting room for growth as demand continues to rise.

This article will provide a detailed analysis of the 1,4-butanediol market's supply and demand, focusing on the drivers of growth, regional insights, and the future outlook, as well as technological developments and sustainability considerations.

Overview of 1,4-Butanediol and Its Applications

1,4-Butanediol (BDO) is a versatile chemical compound used primarily as a precursor in the production of several industrial chemicals. It is a key component in the manufacturing of polybutylene terephthalate (PBT) and polyurethane, two widely used polymers. BDO is also crucial in the production of tetrahydrofuran (THF), gamma-butyrolactone (GBL), and other derivatives used in textiles, automotive parts, and personal care products.

BDO's broad applications make it one of the most important intermediates in the chemical industry. The growing demand for these end-products—especially in automotive, electronics, and consumer goods—drives the increasing global consumption of 1,4-butanediol.

Get a Free Sample Report with Table of Contents@

https://www.expertmarketresearch.com/industry-statistics/1-4-butanediol-market/requestsample

Global Supply and Demand Dynamics of 1,4-Butanediol

Supply Factors

The supply of 1,4-butanediol is concentrated in a few key manufacturing regions, with Asia Pacific accounting for around 80% of the global production capacity. The vast majority of this capacity is located in China, which has historically relied on the acetylene-based Reppe process for producing BDO. This process, which dates back to the early 20th century, remains cost-effective and dominant in the Chinese market. As of 2023, nearly 90% of China's BDO capacity was based on this method, despite increasing interest in alternative, more sustainable production routes.

The main feedstock for the acetylene-based Reppe route is coal, making China’s position in the market heavily tied to the availability and price of coal. Additionally, the demand for BDO production is linked to the cost of key raw materials, including acetylene and butane, as well as advancements in production technologies. While the acetylene-based process has been a historical advantage for China, there is an ongoing push in the industry to adopt cleaner, more energy-efficient production methods, such as the butane-based and propylene-based methods.

The global plant capacity utilization for 1,4-butanediol stood at 73% in 2023. This relatively moderate utilization indicates that there is untapped capacity available to meet future demand growth. While the supply of BDO has been robust in recent years, any significant disruptions in production due to raw material price fluctuations or geopolitical events could impact the stability of global supply chains.

Demand Drivers for 1,4-Butanediol

Automotive and Electronics Industries: The automotive industry is a significant consumer of BDO, with the chemical being used in the production of automotive parts like bumpers, dashboards, and other components made from polyurethane. The increasing demand for lightweight, durable materials in the automotive industry is expected to continue to drive the demand for BDO. Additionally, the electronics industry, where BDO is used in the production of coatings and adhesives, is experiencing steady growth, further fueling the demand for 1,4-butanediol.

Polyurethanes and Plastics: Polyurethane is one of the largest applications for BDO. It is used in the production of foam for insulation, automotive seating, and other molded components. The rising demand for energy-efficient products, especially in the construction and automotive sectors, is driving the demand for polyurethane, thereby boosting BDO consumption. Additionally, the increasing use of PBT in automotive applications and electronics is another significant demand driver for BDO.

Textiles and Consumer Goods: The textile industry uses BDO in the production of fibers like Spandex and Lycra. As consumer demand for athletic wear and performance fabrics continues to rise, BDO usage in textiles is expected to grow. Furthermore, BDO is used in the production of biodegradable plastics, an area that is gaining attention due to the increasing demand for sustainable and eco-friendly materials in consumer goods packaging.

Biodegradable Plastics and Sustainability Trends: Sustainability is a growing concern in many industries, particularly in the automotive, textiles, and packaging sectors. The rise of biodegradable plastics and sustainable production practices has led to increasing interest in BDO derivatives that support these initiatives. For example, THF, derived from BDO, is used in the production of polyurethanes and polymers that meet modern sustainability standards.

Pharmaceuticals and Specialty Chemicals: BDO derivatives like gamma-butyrolactone (GBL) are used in the production of pharmaceutical intermediates and specialty chemicals. The pharmaceutical sector's growing demand for high-quality intermediates will likely contribute to the overall growth of the 1,4-butanediol market.

Regional Insights: Asia Pacific Leads the Market

China: The Dominant Producer

China remains the largest producer and consumer of 1,4-butanediol globally, accounting for approximately 62% of the production capacity in Asia Pacific and 48% of global capacity. The country’s dominance in the BDO market can be attributed to its established manufacturing infrastructure, cost-competitive acetylene-based production processes, and the growing demand from industries such as automotive, textiles, and electronics.

However, China’s reliance on the acetylene-based Reppe route, which utilizes coal as a feedstock, raises concerns about environmental sustainability. As China and other countries in the region strive to meet global sustainability goals, there is increasing interest in transitioning to more eco-friendly production methods, including bio-based BDO and processes that use natural gas or propylene as raw materials.

Asia Pacific: Key Growth Region

In addition to China, other countries in the Asia Pacific region, such as India, Japan, and South Korea, are significant consumers of BDO. India, for example, has seen a surge in demand for BDO, driven by the growth of its automotive and textile industries. With the rise of manufacturing and consumption in these emerging markets, the demand for BDO is expected to continue its upward trajectory in the coming years.

North America and Europe: Stable Demand

North America and Europe are expected to see steady growth in BDO demand, particularly driven by applications in automotive manufacturing and energy-efficient building materials. The region is also witnessing an increased emphasis on sustainable manufacturing practices, such as the production of bio-based BDO and the use of recycled materials. European Union regulations regarding sustainability and carbon emissions are likely to drive innovation and the adoption of alternative, cleaner production methods in BDO manufacturing.

Technological Innovations and Future Trends

The BDO industry is undergoing several technological advancements aimed at improving production efficiency and environmental sustainability. Key trends include:

Bio-based BDO Production: As the chemical industry moves toward more sustainable practices, bio-based BDO production technologies are gaining traction. Companies are investing in innovative processes that use renewable resources, such as sugars and biomass, to produce BDO. Bio-based BDO could reduce the carbon footprint of BDO production and help meet the increasing demand for eco-friendly materials.

Alternative Production Routes: The traditional acetylene-based Reppe process is being gradually supplemented by more energy-efficient and environmentally friendly alternatives, including the butane-based and propylene-based processes. These methods have the potential to lower production costs and reduce environmental impact.

Recycling and Circular Economy: The push towards a circular economy is becoming more significant in BDO applications, particularly in automotive and textiles. Recycling technologies for BDO-derived materials like polyurethanes are evolving, which could drive further demand for BDO in the future.

Sustainability and Environmental Considerations

Sustainability is a growing focus within the BDO industry. The energy-intensive nature of traditional BDO production processes raises concerns about their environmental impact. Consequently, companies are looking for cleaner alternatives and working to improve the energy efficiency of manufacturing processes. Additionally, as the market for biodegradable plastics and environmentally friendly products grows, demand for sustainable BDO derivatives is expected to rise.

Related Reports

https://www.expertmarketresearch.com/articles/top-dairy-companies-in-europe

Media Contact

Company Name: Claight Corporation

Contact Person: Peter Fernandas, Corporate Sales Specialist — U.S.A.

Email: sales@expertmarketresearch.com

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: www.expertmarketresearch.com

Aus Site: https://www.expertmarketresearch.com.au