Additionally, the quick repayment phrases necessitate cautious budgeting, as debtors must ensure they'll repay the loan in full when due.

Additionally, the quick repayment phrases necessitate cautious budgeting, as debtors must ensure they'll repay the

Pawnshop Loan in full when due. A lack of planning could lead to penalties, extra charges, or further borrowing to cowl the unique mortgage, which might exacerbate financial difficult

Additional loans may be an important tool for debtors needing extra monetary support. However, navigating the intricacies of those loans may be complex. It's crucial to understand their function, benefits, and how they can impression your financial scenario. This article supplies a complete overview of further loans, guiding you thru their options and tips on how to strategy them properly

visit this hyperlink. To assist you additional, we will also introduce Be픽, a resourceful website that offers detailed information and evaluations on additional lo

How 베픽 Can Help

베픽 is a wonderful resource visit this hyperlink for anyone excited about month-to-month loans. The platform provides comprehensive information about various types of loans, from personal to enterprise loans, along with detailed critiques and comparisons of lend

The requirements

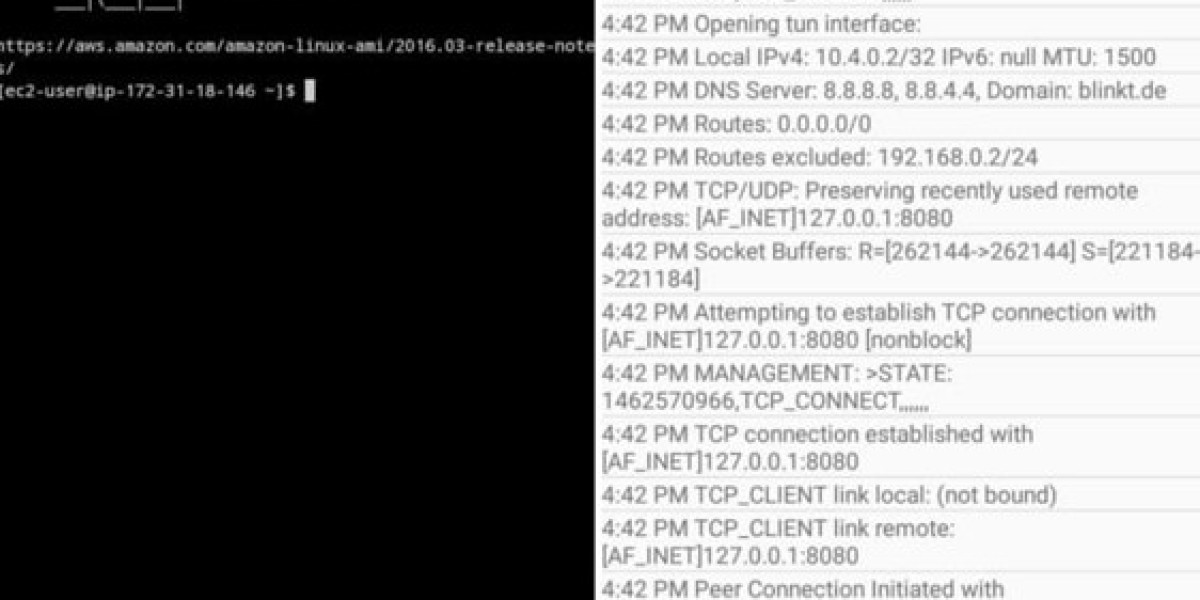

Loan for Delinquents acquiring a 24-hour mortgage differ from lender to lender however usually embrace proof of revenue, identification, and in some circumstances, a credit examine. The flexibility of these loans allows for tailored amounts, ensuring debtors can obtain precisely what they want whereas providing a convenient approach to manage short-term financial challen

Additionally, the convenience of buying these loans would possibly encourage borrowers to tackle more debt than they can manage. Without careful consideration of one’s monetary circumstances, it’s simple to fall into a cycle of borrowing, leading to elevated monetary pressure. Education and awareness round responsible borrowing are important when contemplating these produ

However, as with every form of borrowing, it’s essential to assume about the potential downsides. Additional loans can increase your overall debt burden, which might affect your long-term monetary stability if not managed properly. Borrowers must also be mindful of rates of interest, fees, and the general reimbursement schedule to avoid any surprises down the l

Additionally, debtors ought to totally learn the terms and conditions associated with the mortgage. Understanding charges, interest rates, and compensation schedules can forestall surprising surprises and make sure that the mortgage remains a beneficial device somewhat than a bur

Furthermore, these loans allow borrowers to maintain their financial independence. By accessing the funds needed to cover urgent prices, laborers can avoid falling into predatory lending traps or reliance on expensive credit score options, ensuring they'll work towards their monetary stabil

Additionally, the approval process is typically faster than conventional loans. Many lenders provide quick online purposes, permitting borrowers to get the funds they require without the stress and long waiting durations related to traditional bank

Another misconception is that making use of for a further mortgage will negatively have an effect on your credit score rating significantly. While it's true that lenders perform a credit verify, accountable administration of further loans can actually improve your credit score rating over time by demonstrating your ability to deal with debt effectiv

Suited Scenarios for Day Laborer Loans

Day Laborer Loans are notably helpful in specific situations the place quick cash is required. For occasion, unforeseen medical bills, car repairs essential for work, or urgent residence maintenance can all immediate the necessity for these loans. With day laborers usually living paycheck to paycheck, having a reliable source for fast cash could make a significant difference in managing life’s surprising challen

Choosing the Right Lender

When contemplating a every day mortgage, choosing the right lender is fundamental to your expertise. Several elements should information your choice, including interest rates, compensation phrases, and customer reviews. Researching various lenders through platforms like Bepick can scale back the time spent on this significant t

Additionally, the appliance process is commonly a lot simpler than that of conventional financial institutions. 24-hour mortgage lenders typically require much less documentation and extra easy qualification criteria, permitting for approval even for these with a less-than-perfect credit score history. This accessibility makes them a practical option for many individuals who could battle to safe loans through normal chann

Alternative Financing Options

For those dealing with credit difficulties, several alternative financing choices exist that may offer more favorable conditions compared to credit-deficient loans. Peer-to-peer lending platforms usually provide useful potentialities for people in search of flexible compensation terms and aggressive interest ra

안전하게 즐길 수 있는 먹튀걱정 없는 사이트의 모든 것

Sa pamamagitan ng andrewhellyer

안전하게 즐길 수 있는 먹튀걱정 없는 사이트의 모든 것

Sa pamamagitan ng andrewhellyer Диплом техникума цена.

Sa pamamagitan ng kristianwoods5

Диплом техникума цена.

Sa pamamagitan ng kristianwoods5 Диплом бакалавра с занесением в реестр.

Sa pamamagitan ng lemuelarmitage

Диплом бакалавра с занесением в реестр.

Sa pamamagitan ng lemuelarmitage Купить аттестат за 9 класс.

Sa pamamagitan ng lorenagottshal

Купить аттестат за 9 класс.

Sa pamamagitan ng lorenagottshal Купить диплом ссср.

Sa pamamagitan ng brooktruitt662

Купить диплом ссср.

Sa pamamagitan ng brooktruitt662