Introduction

The Cumene Market Outlook reveals a dynamic and growing industry crucial to the production of important chemicals, such as phenol and acetone. Cumene, also known as isopropylbenzene, is primarily used in the production of phenol and acetone, which serve as key raw materials in industries ranging from automotive to pharmaceuticals. With a global capacity of approximately 21,000 KT (kilotons) in 2023, the cumene market is on a trajectory of steady growth, with production capacity projected to reach 26,500 KT by 2032. The increasing demand for phenol and acetone, as well as the rise of emerging markets, are central drivers of this growth. This article will provide a detailed supply and demand analysis of the cumene market, examining key market trends, production dynamics, and future projections, along with actionable insights for stakeholders in the chemical and industrial sectors.

Supply Side of the Cumene Market

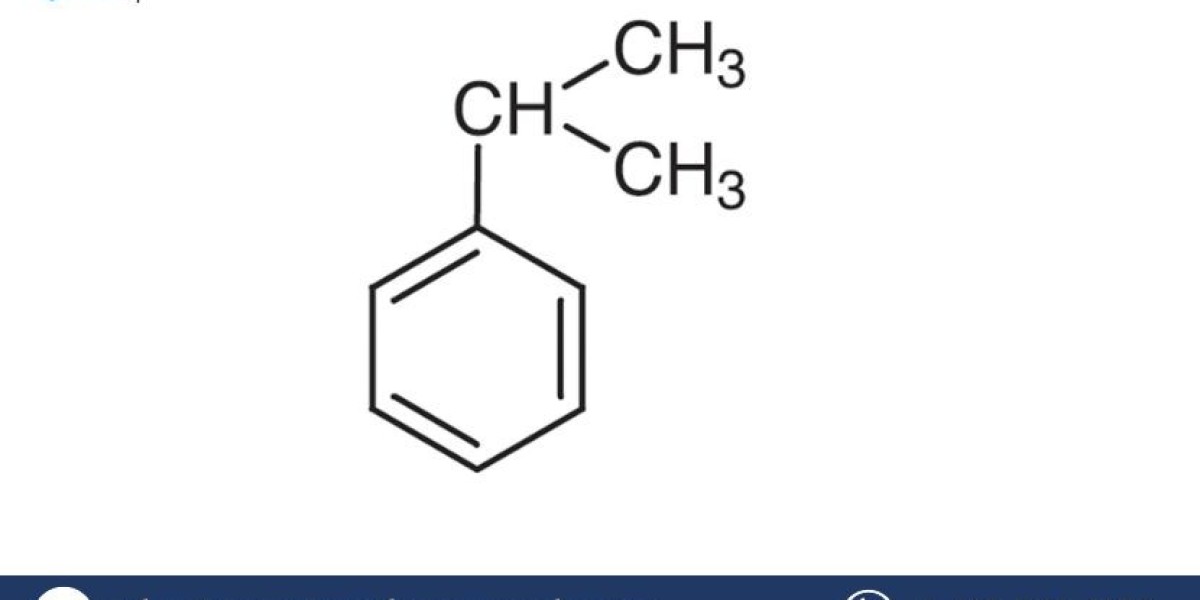

Cumene is primarily produced through the alkylation of benzene with propylene, a reaction that requires careful management of raw material sourcing, production processes, and technology adoption. The supply side of the cumene market is influenced by factors such as feedstock availability, technological advancements, and regional production capacities.

Key Global Producers and Regional Breakdown

The largest producers of cumene are concentrated in regions with established petrochemical industries, notably North America, Europe, and Asia Pacific. In particular, Asia Pacific has emerged as the dominant player, holding a significant share of global production capacity due to its extensive chemical manufacturing infrastructure and increasing industrial demand.

In 2023, global cumene production capacity stood at approximately 21,000 KT, with major contributors being countries such as China, the United States, and India. China, being one of the largest producers of phenol and acetone, continues to ramp up its cumene production capacity to meet the demands of these downstream industries. The country’s booming chemical sector and its growing demand for petrochemical products are central to its strategic focus on cumene production.

The United States, on the other hand, is a major player in North America, with well-established manufacturing plants and robust production capabilities. Leading companies like ExxonMobil and Shell have strategically expanded their cumene production facilities to ensure a reliable supply of phenol and acetone. Furthermore, the Middle East is emerging as a key contributor to the global cumene supply, with countries such as Saudi Arabia and Qatar leveraging their abundant oil and gas reserves to produce cumene and its byproducts.

Capacity Utilization and Projected Growth

As of 2023, the global capacity utilization rate for cumene production remained moderate, reflecting a balance between supply and demand. However, the market is set for significant expansion, with production capacity estimated to increase to 26,500 KT by 2032. This expansion is primarily driven by the growing demand for phenol and acetone, especially in developing economies where industrialization is rapidly advancing.

The expansion of cumene production capacity is also being influenced by advancements in production technologies, such as the development of more efficient catalysts and improved processing techniques. These technological innovations are expected to enhance the overall efficiency of cumene production, reducing costs and increasing output while maintaining environmental compliance.

Get a Free Sample Report with Table of Contents@

https://www.expertmarketresearch.com/industry-statistics/cumene-market/requestsample

Demand Side of the Cumene Market

The demand for cumene is intrinsically linked to the demand for its primary derivatives: phenol and acetone. These chemicals are essential in a wide array of industries, including automotive, pharmaceuticals, construction, and consumer goods. The growing use of cumene-based products, particularly in emerging markets, is fueling demand for cumene and driving market growth.

Applications of Phenol and Acetone

Phenol and acetone, derived from cumene, are crucial components in the production of a wide range of products. Phenol is a vital raw material in the production of plastics, resins, and industrial chemicals, including bisphenol-A (BPA) and phenolic resins. It is also used in the manufacturing of pharmaceuticals, disinfectants, and adhesives. The increasing use of these products in industries such as automotive, electronics, and healthcare is directly contributing to the growing demand for cumene.

Acetone, on the other hand, is a key solvent and is used in the production of cleaning agents, paints, coatings, and personal care products. The growing demand for acetone is driven by the expansion of industries such as automotive, construction, and consumer goods, where it is used in various applications, including coatings, adhesives, and solvents.

Geographical Demand and Emerging Markets

Asia Pacific remains the largest and fastest-growing market for cumene, driven by the demand for phenol and acetone in the region. China, India, and other emerging economies in Southeast Asia have witnessed rapid industrial growth, creating an increasing need for chemicals such as phenol and acetone. This trend is expected to continue in the coming years, as these nations expand their manufacturing and infrastructure sectors.

In North America and Europe, the demand for cumene is also steady, but growth is more moderate compared to the booming markets in Asia. In these regions, the automotive and construction industries continue to be significant consumers of phenol and acetone, maintaining stable demand for cumene. Furthermore, the shift toward sustainability and the adoption of green technologies are expected to impact the production and consumption patterns of cumene derivatives, with growing emphasis on circular economy principles and environmentally friendly chemicals.

Rising Demand for Eco-friendly Solutions

As industries increasingly adopt sustainable practices, the demand for bio-based chemicals and eco-friendly production methods is rising. The cumene market is experiencing a shift toward more sustainable production processes, with an increasing focus on using renewable feedstocks such as biomass-derived propylene. This shift is in response to both regulatory pressures and consumer demand for greener alternatives.

Additionally, the demand for bio-based phenol and acetone, which can be produced using renewable resources and cleaner technologies, is gaining momentum. This trend is expected to create new opportunities in the cumene market, with companies investing in bio-based technologies and sustainable production practices to meet the growing need for environmentally friendly chemicals.

Pricing Dynamics in the Cumene Market

The pricing of cumene is heavily influenced by raw material costs, particularly the prices of benzene and propylene. Since benzene is a derivative of crude oil, changes in global oil prices can significantly affect the cost of cumene production. Additionally, fluctuations in the supply and demand of propylene can lead to price volatility in the cumene market.

In recent years, the prices of raw materials have been subject to fluctuations due to geopolitical events, supply chain disruptions, and changes in energy prices. These factors can lead to significant price volatility in the cumene market, impacting both producers and consumers. The trend toward increased capacity utilization and technological advancements is expected to stabilize prices to some extent, but the market will continue to be susceptible to external factors such as energy costs and raw material supply.

Regional Price Disparities

The price of cumene can vary significantly by region, reflecting differences in production costs, feedstock availability, and market dynamics. In regions with abundant access to cheap feedstocks such as the Middle East, production costs are lower, which allows companies to offer more competitive prices. In contrast, regions that rely on imported raw materials or face logistical challenges may see higher cumene prices.

For example, North America and Europe typically experience higher cumene prices due to the relatively higher costs of raw materials and transportation compared to Asia Pacific and the Middle East. As such, regional disparities in cumene prices create opportunities for cost optimization and strategic sourcing, particularly for companies operating in multiple global markets.

Environmental and Regulatory Impact

The cumene market, like many other sectors in the chemical industry, is subject to increasing environmental regulations. Both the production and use of chemicals derived from cumene can have environmental implications, including greenhouse gas emissions and waste generation.

Environmental Regulations and Sustainability Efforts

Governments worldwide are tightening regulations on chemical manufacturing to reduce environmental impacts and encourage sustainable practices. For example, in Europe, the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation requires companies to assess and manage the environmental impact of chemicals produced within the region.

As a result, companies are increasingly focusing on reducing their carbon footprint and improving the energy efficiency of their production processes. Technological advancements, such as the adoption of renewable feedstocks and cleaner production methods, are helping companies comply with these regulations while maintaining competitive costs.

Circular Economy and Green Chemistry

The rise of the circular economy and green chemistry principles is encouraging the development of more sustainable chemical production methods. In the case of cumene, this includes the exploration of bio-based feedstocks and innovative technologies that minimize waste and improve the sustainability of the production process.